What exactly is weighted with ratings?

Rating means to evaluate, assess, rate or classify. Ratings are used to assess the creditworthiness of a customer. In contrast to the previous credit assessment, which was essentially based on the annual financial statements prepared in accordance with commercial law and was therefore oriented towards the past, the ratings now used must determine the future viability of a company.

The credit rating therefore provides information on the extent to which the company will be able to meet its obligations in the future. The rating thus indirectly determines which risk premium the lender will demand and whether lending is possible at all. The information processed in a rating is of a quantitative nature (company figures) on the one hand, and qualitative statements on the other, e.g. on markets, competitive structure, organisation, corporate processes, planning/control or corporate management.

The instrument of rating itself is a mathematical-statistical model in which individual company characteristics that have been individually or collectively identified as relevant to default are condensed into a rating grade. This rating grade is linked to a probability that the company will become insolvent in the future and will therefore no longer be able to meet its financial obligations. In future, the banks’ pricing policy will be geared even more strongly than before to the risk content of the individual transaction. However, not only the rating note plays a role here, but also the collateralisation of the loan and — albeit to a much lesser extent — the maturity and repayment modality. For example, a “weaker” rating can be compensated by better collateralisation.

Who can create a rating?

In general, there are two different ways to create a rating. The internal rating is created by banks and savings banks and flows into the credit rating. The external rating is created by rating agencies. The largest and best-known external rating agencies are Moody´s, Fitch and Standard & Poors.

These two rating procedures are very different. External rating agencies evaluate criteria that they can derive from mandatory publications of key company figures. This results in economic information that provides information about the creditworthiness of a company. In the case of an internal rating conducted by a bank or savings bank, other so-called “soft criteria” are also used.

Which individual criteria are important for a rating?

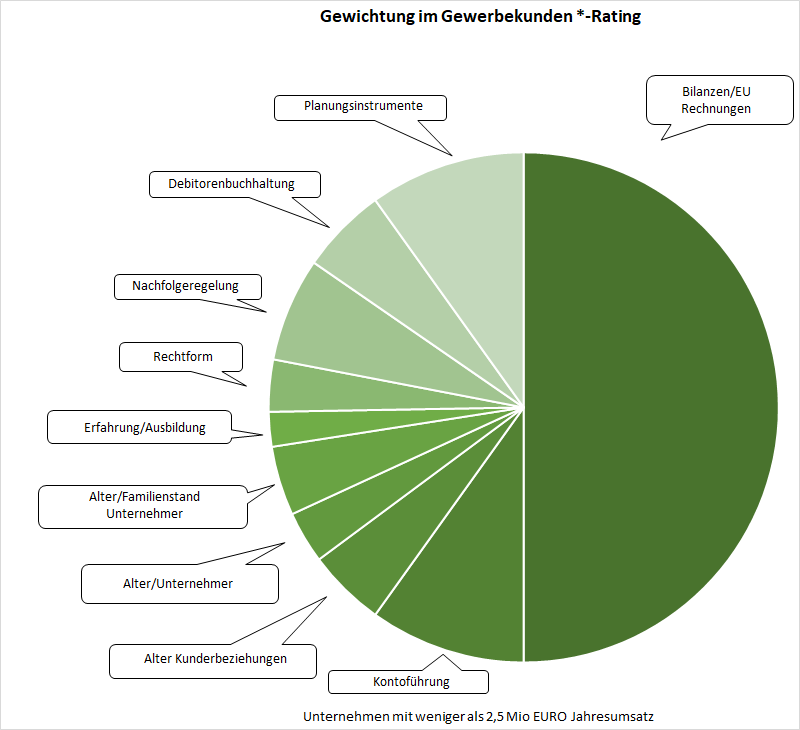

The analysis of the company’s annual financial statements weighs approximately 50%. In this annual accounts analysis, the equity base and earnings situation are of major importance. In addition, liquidity is very important for future-oriented divisions. From individual items in the annual financial statements, combined with account management data (in particular account overdrafts), it is derived whether the liquidity of a company is good or strained and how it develops over time. The development of liquidity allows a quite good forecast of the future solvency of a company and is therefore included in the rating with a high weight.

In addition to annual accounts analysis and liquidity development, qualitative company characteristics are also taken into account. These are characteristics that enable a statement to be made about how carefully a company conducts its business according to plan and commercially, how well trained and experienced its management is and how well the company performs in comparison with other market participants. It is particularly important, for example, whether the company has a functioning dunning system or whether professional and forward-looking liquidity planning is carried out. Open, pro-active communication with the bank and professionally prepared information about the company are also important levers in this regard.

In the rating of corporate customers (turnover figures from 2.5 million EURO) there are smooth transitions in the weighting of key figures within the balance sheet rating. If, for example, the creditor term is still an important indicator for smaller companies, it loses weight with increasing company size. However, the storage period and stock key figure become more important as the size of the company increases.

In order to have a positive influence on creditworthiness and rating, an as-is analysis should first be carried out within the company.

Such an actual assessment is carried out in the form of an analysis and covers all areas of the company that are considered for an assessment. Of course, manufacturing companies differ from service providers and freelancers. Larger manufactories have the corresponding departments that can carry out such an analysis. Small manufactories should use financing and promotion advice.

The most important points with which a small or medium-sized manufactory can positively influence its rating result can be enumerated as follows:

- Strengthening equity capital and improving earnings

- Liquidity planning and agreed account management

- Introduction or optimisation of business management instruments in the company (e.g. planning instruments, accounts receivable).

- Active communication with the bank

- Professional corporate documents

All in all, it can be said that planned, structured action is a success factor for companies. The fact that sales, earnings and liquidity are planned is more important than the way this is done. It is up to each entrepreneur to use “his” method. What advantages does the rating have for your company?

Rating has an important feedback function for entrepreneurs. Through the rating you as an entrepreneur will find out which fields of action are considered to be well covered and where there is still room for improvement. In the case of a rating that does not turn out so well, the consequences for the company are initially not pleasant, but here the manufactory is made aware of its need for action in an initially less “painful” way.

In the best case scenario, the rating will trigger actions that will improve future viability of the manufactory. The primary goal will be to improve the rating. At the same time, the actions will also optimize the entrepreneurial processes and improve the long-term perspective of the company. Beyond this action-triggering effect, the rating will make an important contribution to strengthening the stability of companies.