Many manufactories in Germany are wondering whether they should better finance themselves with equity or debt money. However, this question cannot be answered unequivocally because both financing options have advantages and disadvantages and depend on the financial structure of the company.

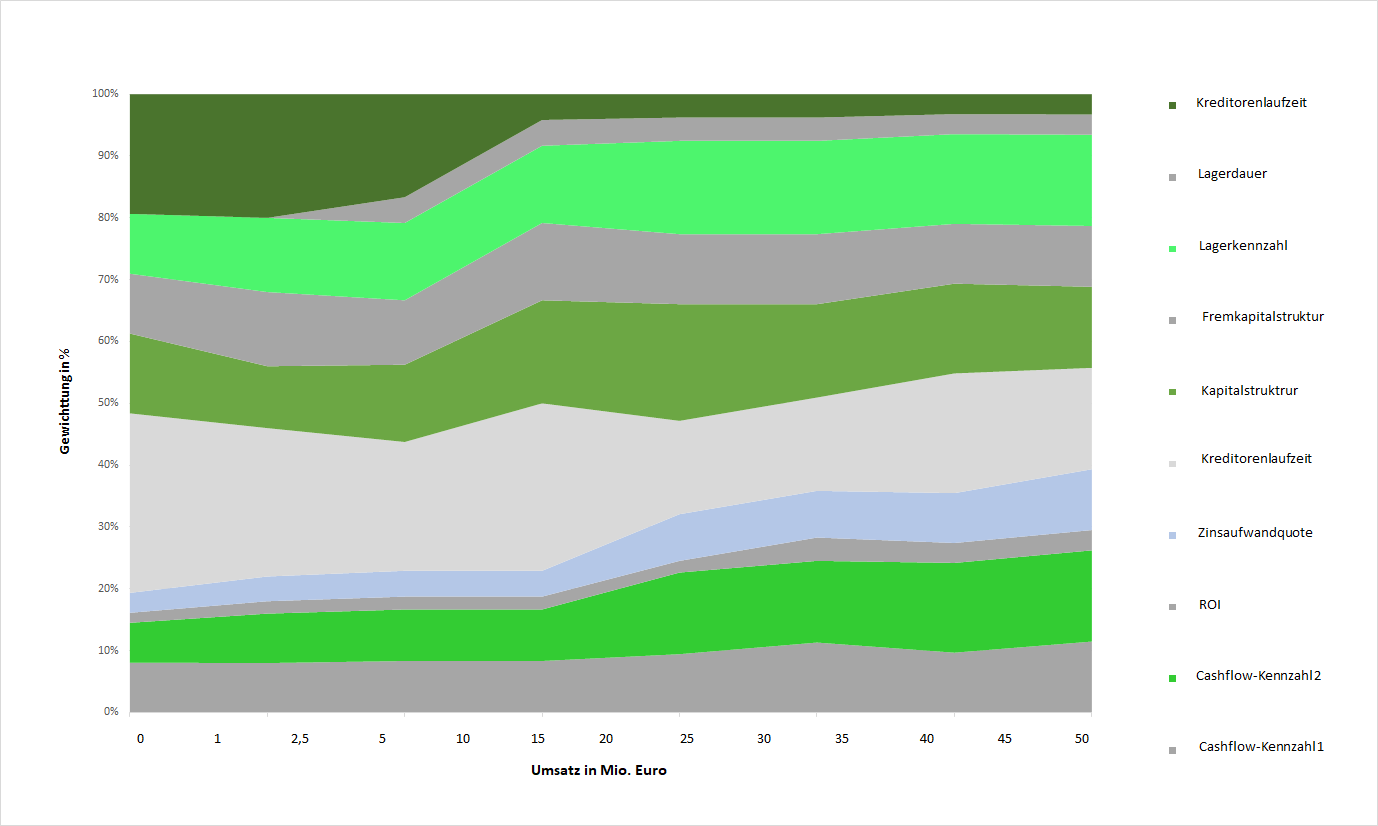

The financing structure of an enterprise becomes particularly relevant in the course of granting loans and ratings, since among other things the equity ratio and the debt-equity ratio flow as a quantitative indicator into the classification of the creditworthiness. Banks used quantitative and qualitative factors to assess the future viability of the company. Key balance sheet figures, such as the equity ratio, are included as quantitative factors, while market developments, account management, company management, etc. have an effect on the rating grade as qualitative criteria.

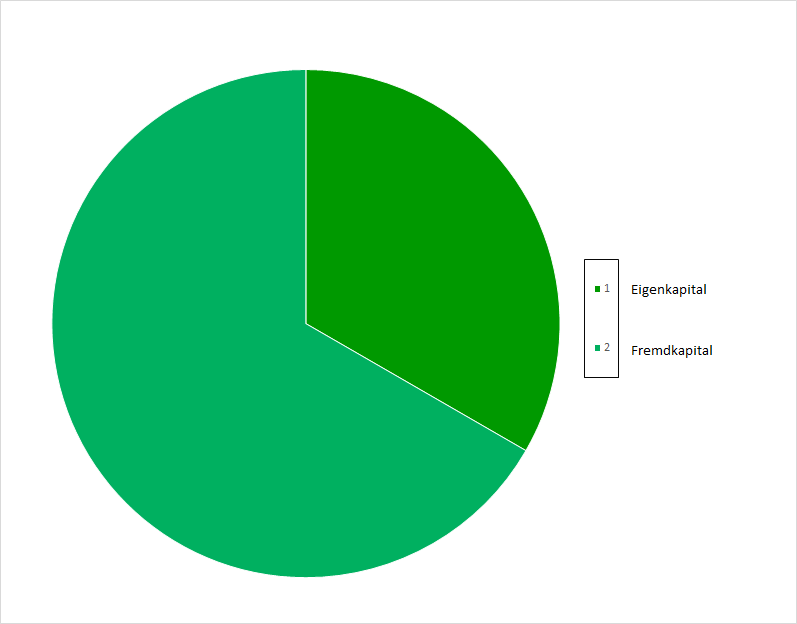

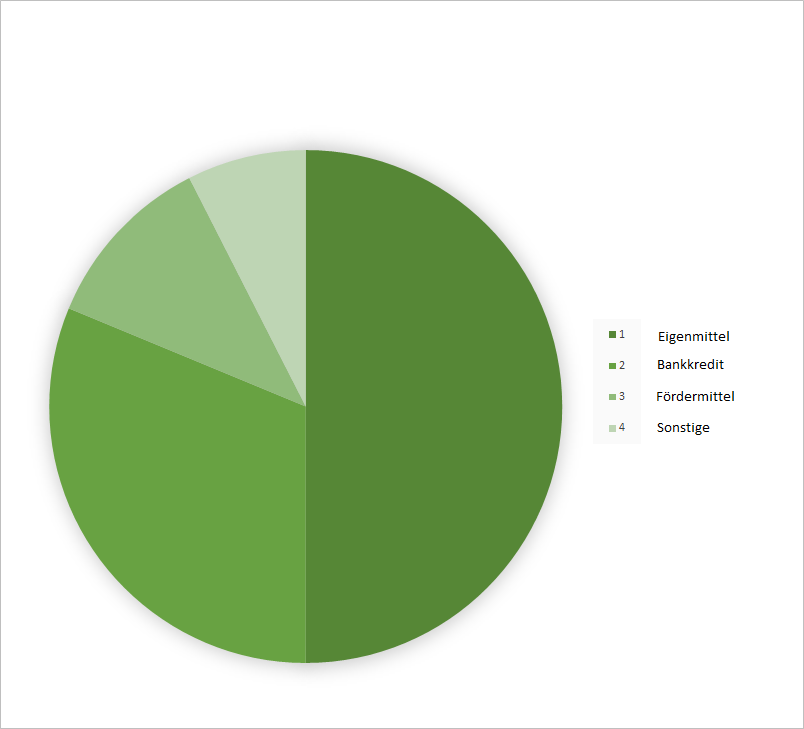

On average, German medium-sized manufactories have an equity ratio of 28.6 %. This figure is just below the general assumption that German companies finance themselves with almost 1/3 equity and 2/3 debt. In the course of investment financing, approx. 52% equity, 30% bank loans, 12% subsidies and 6% other (equity and mezzanine capital) are used.

The fact that the share of equity capital is around 1/3, but that approx. 52% of the investment sum is financed by equity capital, raises the question of whether equity capital and the more favourable form of financing are involved or whether it has become increasingly difficult to obtain bank loans.

In 2018, the share of successful credit negotiations fell by 10 percentage points to 57%. This suggests that banks may have become more restrictive in lending and consequently fewer companies are lending. Negotiations between companies and banks are partly based on rating grades and thus also on key figures such as the equity ratio. If, for example, the equity ratio is too low, banks sometimes refuse loans because the default risk is too high or demand a higher lending rate. For entrepreneurs, this raises the question of whether to exploit leverage effects or optimise ratings.

The leverage effect refers to the possibility that the return on equity will increase if more debt capital is used instead of equity capital. At the same time, the reduction in equity results in a lower equity ratio and a higher debt ratio while debt capital remains unchanged. A higher debt ratio can have a serious impact on the rating and thus on the lending rate, as banks take into account the financial structure of a company, among other things.

It is therefore important for entrepreneurs to weigh up whether the improvement in return on equity or the increase in interest rates for debt capital is more important. Since in most companies the leveraged portion of the capital is greater than the self-financed portion, it is in the interest of the entrepreneur to keep the loan interest rate as low as possible with increasing leverage. This is possible thanks to an improved equity ratio.

The positive effect of a high equity ratio on the rating grade can be generated by several direct and indirect measures to increase the equity ratio and thus optimize the rating.

Reducing the balance sheet total, for example by reducing inventories or using factoring with unchanged equity, indirectly improves the equity ratio. It should be noted, however, that these measures should make economic sense and should not be aimed solely at manipulating the equity ratio.

Direct measures to strengthen the equity ratio include profit retention, a withdrawal and distribution freeze, further capital contributions by shareholders, and differentiated participation systems. It should be noted that the entrepreneur should carefully consider whether an optimization of the rating grade or the return on equity is advantageous for him.

Since March 2019, the Master Council has set up a working group to work on the optimisation of financing structures specifically for manufactories in order to combine measures for various manufactory clusters.

More Information

Contact Person at Meisterrat:

Dr. Boris Karcher

karcher@meisterrat.de